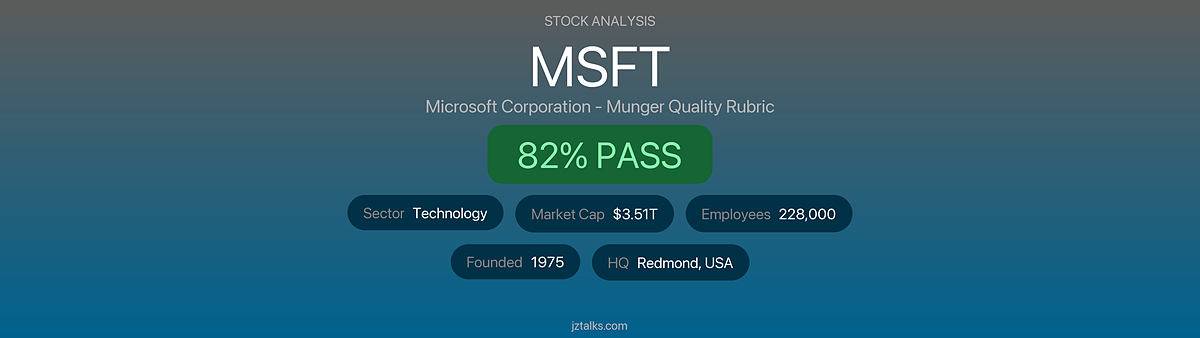

View All Stock Evaluations | Evaluation Date: 2026-01-07

How This Company Makes Money

Microsoft generates revenue through three main segments: (1) Intelligent Cloud (Azure cloud services, server products, enterprise services) – the largest and fastest-growing segment at ~35% of revenue; (2) Productivity and Business Processes (Microsoft 365, LinkedIn, Dynamics 365) – providing subscription-based productivity tools; and (3) More Personal Computing (Windows, Xbox gaming, Surface devices, search advertising). The company benefits from sticky enterprise relationships, with over 85% of Fortune 500 companies using Azure and Microsoft 365 creating high switching costs through embedded workflows.