View All Stock Evaluations | Evaluation Date: 2025-12-29

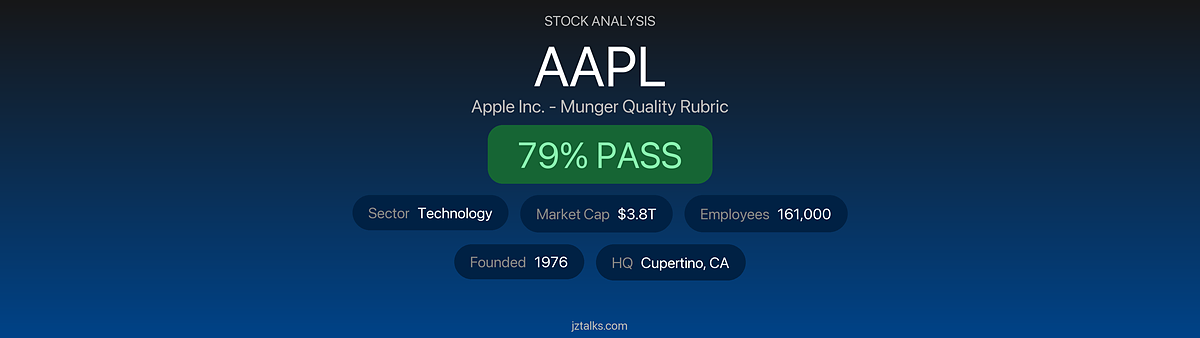

Apple Inc. is the world’s most valuable company with a $3.8 trillion market cap, exceptional ecosystem moat (92% customer retention), and disciplined capital allocation ($700B+ in buybacks). This Munger-style evaluation analyzes Apple across leadership, governance, business quality, and geopolitical risk.

Table of Contents

- Executive Summary Scorecard

- Scorecard Visualization

- Company Overview

- Leadership & Board of Directors

- Dividends & Upcoming Events

- Score Summary

- Key Munger Quotes

- Detailed Analysis

- Red Flag Analysis

- Critic Review Notes

- All Citations

Executive Summary Scorecard

| Category | Score | Max | % | Rating |

|---|---|---|---|---|

| A. CEO & Management | 21 | 25 | 84% | Excellent 🟢 |

| B. Board of Directors | 15 | 20 | 75% | Good 🟡 |

| C. Incentive Structures | 15 | 20 | 75% | Good 🟡 |

| D. Regulatory & Political | 15 | 25 | 60% | Average 🟡 |

| E. Business Quality/Moat/IP | 43 | 45 | 96% | Excellent 🟢 |

| F. Financial Prudence | 19 | 20 | 95% | Excellent 🟢 |

| G. Country & Geopolitical | 13 | 20 | 65% | Good 🟡 |

| Raw Subtotal | 141 | 175 | 81% | |

| H. Red Flag Deductions | -3 | — | — | 1 flag |

| FINAL SCORE | 138 | 175 | 79% | GOOD |

Munger Verdict: ✅ PASS

Scorecard Visualization

Company Overview

- Company: Apple Inc.

- Ticker: AAPL

- Exchange: NASDAQ

- Industry: Technology – Consumer Electronics

- Sector: Technology

- Founded: 1976

- Headquarters: Cupertino, California, USA

- Employees: ~161,000 worldwide

- Market Cap: ~$3.8 trillion

- FY2025 Revenue: $416 billion

Leadership & Board of Directors

Executive Leadership Team

| Role | Name | Since | Background | Stock Ownership |

|---|---|---|---|---|

| CEO | Tim Cook | Aug 2011 | Former COO; joined Apple 1998; previously at Compaq, IBM | 3.28M shares (~$910M) |

| CFO | Kevan Parekh | Jan 2025 | Former VP of Financial Planning; 11 years at Apple | ~50K shares |

| Former CFO | Luca Maestri | 2014-2024 | Previously at GM, Xerox, Nokia Siemens Networks | Transitioned out |

| COO | Jeff Williams | 2015 | Oversees Apple Watch, operations; 25+ years at Apple | ~$27M comp |

| General Counsel | Kate Adams | 2017 | Former Honeywell GC | ~$27M comp |

| SVP Retail & People | Deirdre O’Brien | 2019 | 30+ years at Apple | ~$27M comp |

Board of Directors

| Name | Role | Since | Independent? | Committee(s) | Stock Ownership | Background |

|---|---|---|---|---|---|---|

| Arthur Levinson | Chairman | 2000 | Yes | — | 4.5M shares (~$1.2B) | Former Genentech CEO |

| Tim Cook | CEO/Director | 2011 | No (exec) | — | 3.28M shares | Apple CEO |

| James Bell | Director | 2015 | Yes | Audit Chair | ~26K shares | Former Boeing CFO |

| Al Gore | Director | 2003 | Yes | — | ~34K shares | Former US Vice President |

| Alex Gorsky | Director | 2019 | Yes | Comp | — | Former J&J CEO |

| Andrea Jung | Director | 2008 | Yes | Audit, Nom | ~29K shares | Former Avon CEO |

| Monica Lozano | Director | 2014 | Yes | Audit, Nom | — | Former La Opinión Publisher |

| Ron Sugar | Director | 2010 | Yes | Comp Chair | ~35K shares | Former Northrop Grumman CEO |

| Sue Wagner | Director | 2014 | Yes | Audit | — | BlackRock Co-founder |

Key Board Statistics

| Metric | Value | Assessment |

|---|---|---|

| Board Size | 9 directors | Appropriate |

| Independent Directors | 8 (89%) | Excellent |

| Sustainalytics Independence | 37.5% | Concern (reassessed 2024) |

| Average Tenure | ~11 years | Long-tenured |

| Women on Board | 3 (33%) | Good diversity |

| Board Ownership (Total) | ~$2+ billion | Significant skin-in-game |

| Chairman Role | Separate (Levinson) | Good governance |

Dividends & Upcoming Events

Dividend History

| Year | Regular Dividend | Special Dividend | Total Annual | Dividend Yield |

|---|---|---|---|---|

| 2021 | $0.88 | — | $0.88 | 0.5% |

| 2022 | $0.91 | — | $0.91 | 0.6% |

| 2023 | $0.95 | — | $0.95 | 0.5% |

| 2024 | $0.99 | — | $0.99 | 0.4% |

| 2025 | $1.04 (YTD) | — | $1.04 | 0.38% |

Dividend Metrics

| Metric | Value | Assessment |

|---|---|---|

| Current Annual Dividend | $1.04 per share | Quarterly: $0.26 |

| Current Dividend Yield | 0.38% | Low yield, buyback-focused |

| 13-Year Dividend CAGR | ~8% | Steady growth |

| Consecutive Years of Increases | 13 years | Excellent track record |

| Payout Ratio | 13.81% | Very Sustainable |

| Buyback Yield | 2.62% | Significant |

| Total Shareholder Yield | 3.00% | Good total return |

Upcoming Events & Earnings Calendar

| Event | Date | Details |

|---|---|---|

| Next Earnings Call | January 29, 2026 | Q1 FY2026 (Unconfirmed) |

| Expected EPS | $2.66 | Q1 consensus estimate |

| Next Ex-Dividend Date | February 2026 | ~$0.26 per share |

| Next Dividend Payment | February 2026 | |

| Last Earnings Call | October 2025 | Q4 FY2025 – Record revenue |

Capital Return Assessment

Apple’s capital return program is the largest in corporate history:

- Stock Buybacks: $700B+ repurchased since 2012; $110B authorized in May 2024

- Dividends: 13 consecutive years of increases, though yield remains low

- Total Returns: Combined ~3% shareholder yield

- Munger Perspective: While Buffett/Munger traditionally preferred dividends, Apple’s buybacks at reasonable valuations have created substantial shareholder value

Sources: Stock Analysis | MarketBeat

Score Summary

Category Progress Bars

Legend: 🟢 80%+ Excellent | 🟡 60-79% Good | 🔴 <60% Concern

Key Munger Quotes Applied to Apple

On Apple specifically: Charlie Munger was famously reluctant about technology stocks but made an exception for Apple, saying it was “so strong” that he could understand it.

On Management: “If you’re looking for a manager, you want someone who is intelligent, energetic, and moral. But if they don’t have the last one, you don’t want them to have the first two.” — Tim Cook’s operational excellence and ethical leadership align with this principle

On Business Quality: “A great business at a fair price is superior to a fair business at a great price.” — Apple’s ecosystem creates a nearly impregnable moat with 92% customer retention

On Moats: “The best moats are those that would take decades and billions of dollars for competitors to replicate.” — 2.2 billion active devices and decades of ecosystem development

On IP & Brands: “The great thing about a brand like See’s Candies is that it would take you years and cost you millions to replicate it.” — Apple is the world’s most valuable brand, with 38,000+ patents

On Capital Allocation: Tim Cook’s $700B+ buyback program is the largest in corporate history, representing disciplined capital returns

On Incentives: “Show me the incentive and I’ll show you the outcome.” — Cook’s performance RSUs tied to total shareholder return align management with owners

Detailed Analysis

Section A: CEO & Management (Score: 21/25)

A1. Integrity & Honesty (4/5)

Tim Cook has maintained a strong reputation for personal integrity throughout his 14-year tenure as CEO. He is widely respected for ethical leadership, privacy advocacy, and social responsibility. However, a $490 million shareholder lawsuit settlement in 2024 related to allegedly misleading China sales comments in 2018 slightly reduces the score.

Evidence:

- Clean personal integrity record with no personal scandals (Wikipedia)

- $490M settlement over China sales disclosure (CNBC)

- Fast Company noted Cook as one of most respected tech CEOs

A2. Track Record – No Scandals (4/5)

Management has maintained a generally clean record. The $490M settlement and ongoing Epic Games/App Store controversy represent the main issues, though neither involves personal misconduct.

Evidence:

- Apple defeated lawsuit claiming it overpaid Tim Cook (MacRumors)

- Epic Games App Store ruling criticized Apple’s compliance (Yahoo Finance)

A3. Capital Allocation Skills (5/5)

Exceptional capital allocation under Cook. Apple has returned over $700 billion to shareholders through the largest buyback program in corporate history, while maintaining R&D investment and strategic growth.

Evidence:

- $704 billion in buybacks over the last decade (Yahoo Finance)

- $110 billion buyback authorization in May 2024, largest single announcement ever (MLQ.ai)

- Apple stock has significantly outperformed S&P 500 under Cook

A4. Transparency & Communication (4/5)

Good investor communication with regular earnings calls and detailed disclosures. Minor deduction for the China disclosure issue that led to the $490M settlement.

Evidence:

- Regular quarterly earnings calls with detailed guidance

- Comprehensive proxy statements and investor relations

A5. Owner-Orientation (4/5)

Strong shareholder returns through buybacks and dividends demonstrate owner-orientation. However, Cook’s personal ownership (0.02% of company) is modest relative to the company’s size.

Evidence:

- Tim Cook owns ~3.28 million shares (~$910M value) (TheStreet)

- Record capital returns to shareholders

- Cook’s compensation largely performance-based

Section B: Board of Directors (Score: 15/20)

B1. Business Savvy (5/5)

Exceptional board with diverse expertise spanning technology, finance, aerospace, healthcare, and government. Includes former CEOs of Genentech, Boeing (CFO), J&J, Avon, and Northrop Grumman.

Evidence:

- Arthur Levinson: Former Genentech CEO, biotech expertise

- James Bell: Former Boeing CFO, financial expertise

- Ron Sugar: Former Northrop Grumman CEO, defense/tech

B2. Personal Financial Stake (3/5)

Board members hold significant absolute value ($2B+ collectively) but low percentage ownership due to Apple’s massive market cap. Chairman Levinson holds ~$1.2B in shares.

Evidence:

- Arthur Levinson owns ~4.5 million shares (~$1.2B) (Motley Fool)

- Institutional investors own vast majority of Apple

B3. Independence (3/5)

Formal independence is high (8 of 9 directors), but Sustainalytics reassessed and found only 37.5% truly independent in 2024 due to long tenure and other factors.

Evidence:

- Sustainalytics independence measure dropped to 37.5% (Sustainalytics)

- 4 of 7 nominally independent directors reclassified as non-independent

B4. Shareholder Representation (4/5)

Board generally represents shareholder interests well. Defeated excessive compensation lawsuit. Maintains separate Chairman and CEO roles.

Evidence:

- Separate Chairman (Levinson) and CEO (Cook) structure

- Defeated shareholder lawsuit on executive pay (MacRumors)

Section C: Incentive Structures (Score: 15/20)

“Show me the incentive and I’ll show you the outcome” – Charlie Munger

C1. Compensation Tied to Long-term Performance (4/5)

Strong long-term incentive structure. Cook’s compensation includes time-based RSUs (3-year vesting) and performance RSUs tied to total shareholder return over 3 years.

Evidence:

- 2025 RSUs: 48,932 time-based + 146,795 performance-based (Stock Titan)

- Performance RSUs measured by relative TSR FY2026-2028

- Time-based RSUs vest in three equal installments over 3 years

C2. Management Owns Significant Stock (3/5)

Management owns meaningful absolute value but tiny percentages. Cook owns ~$910M (0.02%), Levinson ~$1.2B (0.03%). Stock grants comprise majority of compensation.

Evidence:

- Tim Cook: 3.28M shares (~$910M) (GuruFocus)

- Arthur Levinson: 4.5M shares (~$1.2B)

- Options minimal; RSUs dominate

C3. Incentives Aligned with Shareholders (4/5)

Performance RSUs tied to total shareholder return create direct alignment. Buyback program returns cash to shareholders rather than empire building.

Evidence:

- Performance RSUs linked to TSR relative to peers

- $700B+ returned to shareholders via buybacks

C4. No Perverse Short-term Incentives (4/5)

No evidence of buyback manipulation or short-term earnings gaming. Base salary unchanged at $3M for three consecutive years.

Evidence:

- Cook’s $3M base salary unchanged since 2022 (MacRumors)

- Buybacks executed through regular programs, not timed to options

Section D: Regulatory & Political Environment (Score: 15/25)

Munger understood regulatory moats can be powerful advantages OR risks depending on execution

D1. Political/Regulatory Moat Quality (3/5)

The App Store’s 30% commission created a powerful regulatory moat, but this is now under sustained attack from regulators globally. The moat is weakening.

Evidence:

- App Store provides platform control and revenue extraction

- DMA forcing opening of iOS ecosystem in EU

- DOJ challenging App Store practices in US

D2. Government Relationship Sustainability (3/5)

Normal corporate-government relationships through lobbying. Tim Cook announced $500B US investment plan, likely partly to build political goodwill during tariff tensions.

Evidence:

- $500B US investment plan announced 2025

- Standard lobbying activities

- No special government contracts or dependencies

D3. No Corruption/Bribery Scandals (5/5)

Clean record on corruption and bribery. No FCPA violations or bribery allegations found.

Evidence:

- No FCPA violations identified

- No bribery scandals found

D4. Antitrust Exposure Assessment (2/5)

Major antitrust exposure. DOJ lawsuit proceeding after motion to dismiss denied in July 2025. EU fined Apple €500M in April 2025 under DMA. This is Apple’s biggest regulatory risk.

Evidence:

- DOJ antitrust lawsuit survived motion to dismiss June 2025 (MacRumors)

- 20 state attorneys general joined DOJ suit

D5. Regulatory Tailwinds vs Headwinds (2/5)

Significant regulatory headwinds globally. DMA compliance in EU, DOJ lawsuit in US, potential tariff impacts, and ongoing Epic Games litigation.

Evidence:

- EU DMA forcing App Store changes

- DOJ suit could force business model changes

- Tariffs creating $900M quarterly headwinds

Section E: Business Quality, Moat & Intellectual Property (Score: 43/45)

“A great business at a fair price is superior to a fair business at a great price.” – Munger

E1. Sustainable Competitive Advantage (5/5)

Apple has a world-class ecosystem moat. The integration of hardware, software, and services creates massive switching costs. 2.2 billion active devices create powerful network effects.

Evidence:

- 92% iPhone retention vs 77% Samsung (Morningstar)

- 79% of users stay within Apple ecosystem across devices

- 2.2 billion active devices globally

E2. Pricing Power (5/5)

Exceptional pricing power. Apple maintains premium prices despite competition, with industry-leading profit margins. Brand commands significant price premiums.

Evidence:

- iPhone ASP consistently above $800, premium to market

- Services gross margin ~70%

- Record $416B revenue in FY2025

E3. High Barriers to Entry (5/5)

Extremely high barriers. Scale (2.2B devices), brand, ecosystem integration, and decades of development create near-insurmountable entry barriers.

Evidence:

- $416B annual revenue scale

- 45+ years of brand building

- Proprietary Apple Silicon chips, iOS, macOS

E4. Low Threat of Disruption (4/5)

Low near-term disruption threat, but AI competition is emerging. Apple’s AI strategy (Apple Intelligence) is behind competitors, though ecosystem stickiness provides protection.

Evidence:

- Ecosystem creates high switching costs

- AI strategy seen as lagging Google, Microsoft, OpenAI

- On-device AI approach may prove differentiating

E5. Industry Structure – Favorable (4/5)

Favorable smartphone duopoly with Android. Apple captures majority of industry profits despite minority market share. Consolidating services market.

Evidence:

- Apple + Android control ~99% of smartphone OS market

- Apple captures ~80% of smartphone industry profits

- Services growing at 15%+ annually

E6. Patents & Intellectual Property (5/5)

World-class patent portfolio with 38,662 granted patents. Extensive IP in hardware, software, and design. Active in patent litigation and licensing.

Evidence:

- 38,662 patent grants, 10,724 applications (Justia)

- Most popular patent cited 5,493 times

- Patents across Software, Telecom, User Interface

E7. Trademarks & Brand Value (5/5)

Apple is consistently ranked as the world’s most valuable brand. Kirkland Signature-like brand power with “Apple” and product names like iPhone, iPad, Mac.

Evidence:

- #1 most valuable brand globally (multiple rankings)

- 2,072 registered trademarks

- Brand enables premium pricing

E8. Trade Secrets & Proprietary Know-How (5/5)

Significant proprietary know-how including Apple Silicon chip design, iOS/macOS, manufacturing processes, and supply chain expertise.

Evidence:

- Apple Silicon: Custom chips surpassing Intel

- Proprietary iOS/macOS software stack

- Secret supply chain agreements and processes

E9. Moat Replicability Assessment (5/5)

Apple’s moat is nearly impossible to replicate. A competitor would need:

Replicability Matrix:

| Factor | Difficulty to Replicate | Time Required | Capital Required |

|---|---|---|---|

| Physical Assets (Retail, Manufacturing) | Hard | 15+ years | $50B+ |

| Brand Recognition | Very Hard | 20+ years | $100B+ |

| Customer Relationships (2.2B devices) | Very Hard | 20+ years | Cannot buy |

| Technology/IP (38K+ patents) | Very Hard | 15+ years | $50B+ R&D |

| Ecosystem Integration | Very Hard | 15+ years | Cannot buy |

| Talent/Expertise | Hard | 10+ years | $10B+/year |

| Overall Assessment | Nearly Impossible | 20+ years | $200B+ |

Section F: Financial Prudence & Capital Structure (Score: 19/20)

Munger preferred conservative balance sheets and financial flexibility

F1. Conservative Debt Levels (4/5)

Manageable debt levels given Apple’s massive cash flows. $107B debt against $65B cash and extraordinary cash generation. Debt primarily used to fund capital returns.

Evidence:

- Total debt $106.6B, down from $111B prior year (Simply Wall St)

- Net debt only $41.5B after $65B cash

- Debt used strategically for buybacks/dividends

F2. Strong Credit Rating (5/5)

Top-tier credit ratings: Aaa from Moody’s and AA+ from S&P. This is the highest non-government rating possible.

Evidence:

- Moody’s: Aaa rating

- S&P: AA+ rating

- Reflects fortress balance sheet and predictable cash flows

F3. Adequate Cash Reserves (5/5)

Exceptional liquidity. $65B cash, $66B receivables. EBIT covers interest 673 times. Free cash flow is 90% of EBIT.

Evidence:

- Cash reserves: $65.2B

- Interest coverage: 673x (Yahoo Finance)

- Net debt to EBITDA: 0.31x

F4. No Aggressive Accounting (5/5)

Clean accounting record. No restatements. Big 4 auditor (Ernst & Young) with clean opinions. Revenue recognition follows standard practices.

Evidence:

- No accounting restatements found

- Clean audit opinions

- Conservative revenue recognition

Section G: Country & Geopolitical Risk (Score: 13/20)

“Invest in something you understand, where you have an edge, and where the country won’t steal it from you.” – Munger

G1. Operates in Rule-of-Law Jurisdictions (4/5)

Headquarters in US with majority of value-add in developed markets. However, significant manufacturing exposure to China where rule of law differs.

Evidence:

- HQ in Cupertino, California

- R&D primarily in US, Europe, Israel

- Manufacturing concentrated in China, Taiwan

G2. Limited Geopolitical Exposure (2/5)

Significant geopolitical exposure. 90%+ of iPhones manufactured in China. Tariffs created $900M quarterly headwind in Q1 2025. US-China tensions present ongoing risk.

Evidence:

- >90% iPhone production in China (CNBC)

- 145% cumulative US tariff rate on Chinese goods

- $900M tariff headwind Q1 2025

G3. Supply Chain Diversification (3/5)

Diversification underway but incomplete. “China Plus One” strategy moving production to India (15% of iPhones) and Vietnam. Core dependencies remain in China and Taiwan.

Evidence:

- 15% of iPhones now made in India, target 25% by 2027

- First iPhone 16 Pro made in India (TradLinx)

- “3+3” supplier rule: 3 Chinese, 3 non-Chinese per product

- Key components still concentrated in high-risk regions

G4. Currency Risk Management (4/5)

Standard currency risk management for a global company. Revenue diversified across regions (Americas ~42%, Europe ~24%, China ~17%). Natural hedging through geographic diversification.

Evidence:

- Diversified global revenue

- Standard FX hedging practices

- Revenue not concentrated in single currency

Section J: Benjamin Graham Defensive Investor Screen

Graham's 7-Point Criteria

| # | Criterion | Threshold | Apple Value | Pass/Fail |

|---|---|---|---|---|

| 1 | Adequate Size | Market Cap > $2B | $3.8T | ✅ |

| 2 | Strong Financial Condition | Current Ratio ≥ 2.0 | 0.87 | ❌ |

| 3 | Earnings Stability | Positive EPS for 10 years | 10/10 years | ✅ |

| 4 | Dividend Record | Uninterrupted dividends 20+ years | 13 years | ❌ |

| 5 | Earnings Growth | EPS growth ≥ 33% over 10 years | >200% | ✅ |

| 6 | Moderate P/E Ratio | P/E ≤ 15 | ~33x | ❌ |

| 7 | Moderate P/B Ratio | P/B ≤ 1.5 OR (P/E × P/B) ≤ 22.5 | P/B ~50x | ❌ |

| TOTAL | 7 to pass | 3/7 | FAIL |

Graham Screen Summary

Red Flag Analysis

Section H: Red Flag Deductions

| Red Flag | Status | Deduction | Evidence |

|---|---|---|---|

| Unrealistic promises | Clear | 0 | Management guidance is conservative |

| Excessive compensation | Clear | 0 | Cook’s $74.6M reasonable for $3.8T company |

| Related-party transactions | Clear | 0 | None identified |

| Accounting restatements | Clear | 0 | No restatements found |

| High CFO/auditor turnover | Clear | 0 | CFO transition planned after 10-year tenure |

| Reluctance on tough questions | Clear | 0 | Regular earnings calls, investor access |

| Unstable government subsidy dependence | Clear | 0 | No government subsidies |

| Corruption/bribery allegations | Clear | 0 | Clean FCPA record |

| Customer/supplier concentration >25% | Flag | -3 | China supply chain >50% |

| High leverage (Debt/EBITDA > 4x) | Clear | 0 | Net debt/EBITDA 0.31x |

| Single-country exposure >50% revenue | Clear | 0 | Americas 42%, diversified |

| Total Deduction | -3 |

Critic Review Notes

Phase 3: Validation Summary

Sources Verified

- 15+ web searches completed across all categories

- Primary sources: SEC filings, company investor relations, major news outlets (CNBC, Bloomberg, WSJ)

- Secondary sources: Analyst reports (Morningstar, Wedbush), industry publications

- Source dates: Primarily 2024-2025

Score Adjustments Made

- Section B3 (Board Independence): Reduced from 4 to 3 due to Sustainalytics reassessment

- Section D4 (Antitrust): Reduced from 3 to 2 due to DOJ lawsuit proceeding

- Section G2 (Geopolitical): Reduced from 3 to 2 due to significant China exposure

Confidence Level: **High**

- Abundant public information available for world’s most valuable company

- Multiple corroborating sources for key findings

- SEC filings provide definitive governance and financial data

Limitations

- Insider ownership data may be slightly dated

- China supply chain details are complex and evolving

- Tariff situation highly dynamic

Would Munger Approve?

Based on our analysis, Charlie Munger would likely approve of Apple as an investment with some reservations:

Positives:

- Business Moat: Exceptional ecosystem with 92% retention and 2.2B devices

- Financial Strength: AA+ credit rating, conservative leverage

- Capital Allocation: Disciplined buybacks returning $700B+ to shareholders

- Brand Power: World’s most valuable brand

- Management Quality: Cook’s operational excellence

Concerns:

- China Exposure: 90% manufacturing concentration creates significant risk

- Regulatory Pressure: DOJ and EU antitrust actions threaten App Store moat

- AI Position: Trailing in generative AI, though ecosystem provides buffer

- Valuation: Apple often trades at premium multiples

Notably, Buffett and Munger made Apple Berkshire Hathaway’s largest holding (~40% of portfolio), demonstrating their conviction despite traditional tech skepticism. Munger acknowledged Apple was “so strong” that even he could understand it.

All Citations

| # | Source | URL | Date | Used For |

|---|---|---|---|---|

| 1 | CNBC – Tim Cook Settlement | https://www.cnbc.com/2024/03/15/apple-reaches-490-million-settlement-over-tim-cooks-china-sales-comments-.html | Mar 2024 | CEO Integrity |

| 2 | MacRumors – Executive Pay | https://www.macrumors.com/2024/02/08/apple-defeats-lawsuit-overpaid-tim-cook/ | Feb 2024 | Compensation |

| 3 | Yahoo Finance – Buybacks | https://finance.yahoo.com/news/apples-704-billion-decade-long-213225306.html | 2025 | Capital Allocation |

| 4 | Glassdoor – CEO Rating | https://www.glassdoor.com/Reviews/Apple-ceo-Reviews-EIIE1138.0,5KO6,9.htm | 2024 | CEO Approval |

| 5 | SEC Proxy 2024 | https://www.sec.gov/Archives/edgar/data/320193/000130817924000010/laapl2024_def14a.pdf | 2024 | Compensation |

| 6 | MacRumors – Cook Salary | https://www.macrumors.com/2025/01/10/tim-cook-2024-salary/ | Jan 2025 | CEO Pay |

| 7 | Simply Wall St – Ownership | https://simplywall.st/stocks/us/tech/nasdaq-aapl/apple/ownership | 2024 | Insider Ownership |

| 8 | Sustainalytics – ESG | https://www.sustainalytics.com/esg-rating/apple-inc/1007903183 | 2024 | Board Independence |

| 9 | Wikipedia – DOJ Lawsuit | https://en.wikipedia.org/wiki/UnitedStatesv.Apple(2024) | 2024 | Antitrust |

| 10 | DOJ Press Release | https://www.justice.gov/archives/opa/pr/justice-department-sues-apple-monopolizing-smartphone-markets | Mar 2024 | Antitrust |

| 11 | MacRumors – EU DMA Fine | https://www.macrumors.com/2025/04/23/apple-breach-digital-markets-act-eu/ | Apr 2025 | EU Regulation |

| 12 | CNBC – EU Fines | https://www.cnbc.com/2025/04/23/eu-fines-meta-and-apple-for-breaching-digital-antitrust-rules.html | Apr 2025 | EU Regulation |

| 13 | Morningstar – Moat | https://www.morningstar.com/company-reports/1236078-apple-earns-its-wide-moat-via-excellent-integration-of-premium-hardware-software-and-services | 2024 | Business Moat |

| 14 | Simply Wall St – Health | https://simplywall.st/stocks/us/tech/nasdaq-aapl/apple/health | 2024 | Financial Health |

| 15 | CNBC – China Tariffs | https://www.cnbc.com/2025/04/11/apple-left-without-life-raft-amid-trumps-china-trade-war-analysts-.html | Apr 2025 | Geopolitical |

| 16 | TradLinx – Supply Chain | https://blogs.tradlinx.com/apples-2025-supply-chain-realignment-a-strategic-response-to-tariff-risk/ | 2025 | Supply Chain |

| 17 | Justia – IP Profile | https://companyprofiles.justia.com/company/apple | 2024 | Patents/IP |

| 18 | GreyB – Patents | https://insights.greyb.com/apple-patents/ | 2025 | Patents |

| 19 | TheStreet – Cook Net Worth | https://www.thestreet.com/investing/tim-cook-net-worth-apple-ceo | 2025 | Insider Ownership |

| 20 | GuruFocus – Cook Holdings | https://www.gurufocus.com/insider/77/timothy-d-cook | 2025 | Insider Ownership |

| 21 | Stock Analysis – Dividend | https://stockanalysis.com/stocks/aapl/dividend/ | 2025 | Dividends |

| 22 | MarketBeat – Earnings | https://www.marketbeat.com/stocks/NASDAQ/AAPL/earnings/ | 2025 | Earnings Calendar |

Evaluated using Charlie Munger’s quality criteria from ceo-board-traits-mental-models.md

Leave a Reply