View All Stock Evaluations | Evaluation Date: 2026-01-05

How This Company Makes Money

MercadoLibre is Latin America’s dominant e-commerce and fintech ecosystem. The company generates revenue through marketplace transaction fees (59% of revenue), digital payment processing via Mercado Pago (41% of revenue), shipping/logistics services (Mercado Envios), advertising (Mercado Ads), and a rapidly growing credit business offering consumer and merchant loans across 18 Latin American countries.

Table of Contents

- Executive Summary Scorecard

- Company Overview

- Leadership & Board of Directors

- Business Model Visual

- Dividends & Upcoming Events

- Competitor Comparison Summary

- Visual Score Summary

- Key Graham/Buffett/Munger Quotes Applied

- Detailed Analysis

- Sections A through H

- Section J: Benjamin Graham Screen

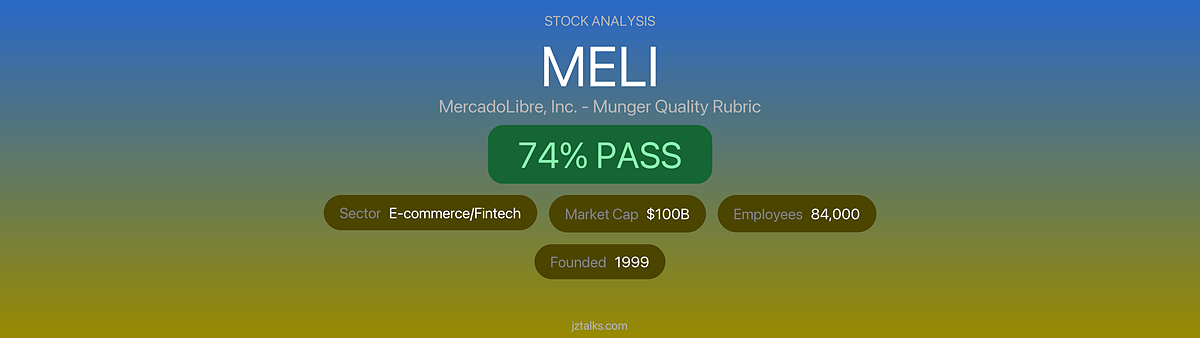

Executive Summary Scorecard

| Category | Score | Max | % | Rating |

|---|---|---|---|---|

| A. CEO & Management | 22 | 25 | 88% | 🟢 |

| B. Board of Directors | 16 | 20 | 80% | 🟢 |

| C. Incentive Structures | 16 | 20 | 80% | 🟢 |

| D. Regulatory & Political | 17 | 25 | 68% | 🟡 |

| E. Business Quality & Moat | 30 | 35 | 86% | 🟢 |

| F. Financial Strength | 28 | 35 | 80% | 🟢 |

| G. Country & Geopolitical | 10 | 15 | 67% | 🟡 |

| H. Valuation & Margin of Safety | 22 | 35 | 63% | 🟡 |

| Raw Subtotal | 161 | 210 | ||

| I. Red Flag Deductions | -6 | 0 | 2 flags | |

| TOTAL | 155 | 210 | 73.8% | |

| Normalized Score | 73.8% | 100% | ||

| J. Graham Screen | 2/7 | Info | ❌ FAIL |

Munger Verdict: ✅ PASS

Rating Guide: 🟢 = 80%+ | 🟡 = 60-79% | 🔴 = <60% Verdict: ✅ PASS (70%+) | ⚠️ CAUTION (55-69%) | ❌ FAIL (<55%)

Company Overview

- Company: MercadoLibre, Inc.

- Ticker: MELI

- Exchange: NASDAQ

- Industry: E-commerce / Fintech

- Sector: Consumer Discretionary / Technology

- Founded: 1999

- Headquarters: Montevideo, Uruguay (incorporated in Delaware)

- Employees: ~84,000 (including logistics workforce)

- Market Cap: $100.06 billion (Jan 2026)

- FY 2024 Revenue: $20.78 billion

Revenue Breakdown by Segment (FY 2024)

| Segment | FY Revenue | % of Total | YoY Growth | Trend |

|---|---|---|---|---|

| Commerce (Marketplace + Shipping) | $12.2B | 59% | +48.3% | 🟢 |

| Fintech (Mercado Pago) | $8.6B | 41% | +24.8% | 🟢 |

| Advertising (Mercado Ads) | ~$1.0B | ~5% | +37% | 🟢 |

| Credit Portfolio | $6.6B | (assets) | +74% | 🟢 |

Geographic Revenue Mix (2024)

| Region | % of Revenue | Trend | Note |

|---|---|---|---|

| Brazil | 55% | 🟢 | Largest market, $5.8B investment |

| Mexico | 22% | 🟢 | Fastest growing, $3.4B investment |

| Argentina | 18% | 🟡 | Origin market, currency volatility |

| Other (Chile, Colombia, Peru, etc.) | 5% | 🟢 | Expansion markets |

Leadership & Board of Directors

Executive Leadership

| Role | Name | Notable Background |

|---|---|---|

| Executive Chairman (from Jan 2026) | Marcos Galperin | Founder, Stanford MBA, Argentina’s richest person |

| CEO (from Jan 2026) | Ariel Szarfsztejn | Former Commerce President, Stanford MBA |

| CFO | Martín de los Santos | Former SVP Credits, Stanford MBA, ex-Goldman Sachs |

| COO | Daniel Rabinovich | Executive VP, 20+ years at company |

| President, Fintech | Osvaldo Giménez | Mercado Pago leader, fintech pioneer |

Board of Directors

| Role | Name | Notable Background |

|---|---|---|

| Executive Chairman | Marcos Galperin | Founder since 1999 |

| Director | Nicolas Aguzin | CEO of Hong Kong Exchanges, ex-JP Morgan |

| Director | Andrea Petroni | Head at JP Morgan, Globant board member |

| Director | Richard Sanders | Partner at Permira, Allegro.eu director |

| Director | Susan L. Segal | Americas Society CEO, Scotiabank director |

| Director | Mario Vázquez | Globant & Despegar board member |

Business Model Visual

Dividends & Upcoming Events

Dividend Status

- Current Dividend: None (suspended in 2018)

- Last Dividend: $0.15/share (January 2018)

- Policy: Reinvesting all earnings into growth

Upcoming Events

| Event | Expected Date |

|---|---|

| Q4 2025 Earnings | February 24, 2026 |

| New CEO Takes Office | January 1, 2026 (completed) |

| Annual Shareholder Meeting | June 2026 (TBD) |

Competitor Comparison Summary

| Company | Market Cap | TTM Revenue | YoY Growth | P/E | Focus |

|---|---|---|---|---|---|

| MercadoLibre (MELI) | $100B | $26.2B | +37% | 50x | LatAm e-commerce + fintech |

| Amazon (AMZN) | $2.3T | $620B | +11% | 45x | Global e-commerce + cloud |

| Sea Ltd (SE) | $60B | $15B | +23% | 35x | SEA e-commerce (Shopee) |

| Nu Holdings (NU) | $65B | $10B | +52% | 32x | LatAm digital banking |

| PDD Holdings (PDD) | $150B | $55B | +86% | 10x | China + global (Temu) |

Visual Score Summary

Key Graham/Buffett/Munger Quotes Applied

“A great business at a fair price is superior to a fair business at a great price.” — Charlie Munger

MercadoLibre exemplifies this principle: a dominant business with strong moats, though not trading at a deep discount.

“In business, I look for economic castles protected by unbreachable moats.” — Warren Buffett

MELI’s integrated ecosystem (marketplace + payments + logistics + credit) creates a powerful flywheel that competitors struggle to replicate.

“Show me the incentive and I’ll show you the outcome.” — Charlie Munger

Management’s significant stock ownership and long-term compensation structure aligns them with shareholders.

“The margin of safety is always dependent on the price paid.” — Benjamin Graham

At 50x P/E, MELI provides limited margin of safety despite its quality, requiring continued execution.

Detailed Analysis

Section A: CEO & Management (Score: 22/25)

“If you’re looking for a manager, you want someone intelligent, energetic, and moral. But if they don’t have the last one, you don’t want the first two.” — Charlie Munger

A1. Integrity & Honesty (5/5)

Marcos Galperin has led MercadoLibre for 26 years with an exemplary reputation. No scandals or ethical lapses on record. Transparent communication with investors and analysts.

- Evidence: Consistent messaging in earnings calls; praised by analysts for candor (Investor Relations)

A2. Track Record – No Scandals (5/5)

No personal or corporate scandals involving leadership. Clean regulatory history for management team.

- Evidence: SEC filings show no restatements or enforcement actions (SEC EDGAR)

A3. Capital Allocation Skills (4/5)

Strong track record building Mercado Pago, logistics network, and credit business. However, some concern about heavy investments amid rising competition.

- Evidence: $5.8B Brazil investment, $3.4B Mexico investment in 2024-2025; ROIC of ~18-25% (MacroTrends)

A4. Transparency & Communication (4/5)

Regular earnings calls, CFO perspectives series, detailed shareholder letters. Some complexity in fintech accounting metrics.

- Evidence: Quarterly investor presentations and podcasts (Investor Relations)

A5. Owner-Orientation (4/5)

Founder Galperin maintains significant ownership (~$1.1B). Leadership transition to internal candidate shows long-term succession planning. No dividends but reinvesting for growth.

- Evidence: Founder ownership, internal CEO succession (GuruFocus)

Section B: Board of Directors (Score: 16/20)

B1. Business Savvy (4/5)

Board includes executives from JP Morgan, Permira, Hong Kong Exchanges. Deep financial services and technology expertise.

- Evidence: Nicolas Aguzin (HKEX CEO), Andrea Petroni (JP Morgan), Richard Sanders (Permira) (Board of Directors)

B2. Personal Financial Stake (4/5)

Directors have meaningful ownership. Galperin holds ~$1.1B. Board compensation includes stock-based awards tied to performance.

- Evidence: Proxy statement disclosures (SEC DEF14A)

B3. Independence (4/5)

Majority of board is independent. ISS Board governance score of 9 (on 1-10 scale, 10 = higher risk) indicates room for improvement.

- Evidence: ISS Governance QualityScore of 8 overall (Yahoo Finance)

B4. Shareholder Representation (4/5)

Board conducts annual self-assessments. Lead independent director follows up on feedback. Some institutional pressure for improved ESG disclosure.

- Evidence: Corporate governance documents (Investor Relations)

Section C: Incentive Structures (Score: 16/20)

“Show me the incentive and I’ll show you the outcome.” — Charlie Munger

C1. Compensation Tied to Long-term Performance (4/5)

Long-Term Retention Plan (LTRP) pays out over 6 years with variable components tied to stock price. CEO compensation 96% stock-based.

- Evidence: 2024 CEO compensation: $13.7M, 95.9% stock-based (Salary.com)

C2. Management Owns Significant Stock (4/5)

Galperin owns ~456,662 shares worth ~$1.1B. However, he sold $188M in stock in August 2024 after share price surge.

- Evidence: SEC Form 4 filings (TipRanks)

C3. Incentives Aligned with Shareholders (4/5)

Annual bonuses tied to net revenues, operating income, TPV, and customer NPS. Company achieved 96.6% of target in 2024.

- Evidence: Proxy statement compensation discussion (SEC DEF14A)

C4. No Perverse Short-term Incentives (4/5)

No evidence of earnings manipulation or buyback timing games. Minimal buybacks overall ($4M approved in 2025).

- Evidence: Limited buyback history shows focus on reinvestment (Motley Fool)

Section D: Regulatory & Political Environment (Score: 17/25)

D1. Political/Regulatory Moat Quality (3/5)

Fintech licensing provides some moat but also regulatory burden. Brazil Central Bank increasing capital requirements. No government contracts or monopoly protections.

- Evidence: Regulatory capital requirements increased to 10.5% from Jan 2025 (SEC Filings)

D2. Government Relationship Sustainability (3/5)

Generally positive relations but subject to changing political winds. Argentina’s new government (Milei) supportive; Brazil and Mexico scrutinizing tech platforms.

- Evidence: Argentina minister defended MELI against bank complaints (Rest of World)

D3. No Corruption/Bribery Scandals (5/5)

No FCPA violations, bribery investigations, or corruption allegations on record.

- Evidence: Clean regulatory history in SEC filings

D4. Antitrust Exposure Assessment (3/5)

Active antitrust scrutiny in Mexico (Cofece) and Argentina (MODO complaint). 85% market share with Amazon in Mexico raises concerns.

- Evidence: Mexico Cofece investigation found “no effective competition” (Digital Commerce 360)

D5. Regulatory Tailwinds vs Headwinds (3/5)

Mixed environment: Brazil’s PIX benefited Mercado Pago but also created competition. Increased fintech regulation across LatAm.

- Evidence: Brazil LGPD compliance, increasing regulatory capital requirements (PESTLE Analysis)

Section E: Business Quality & Moat (Score: 30/35)

“The best moats are those that would take decades and billions of dollars to replicate.” — Charlie Munger

E1. Sustainable Competitive Advantage (5/5)

Multiple reinforcing moats: network effects (218M+ users, 1M+ sellers), integrated ecosystem, logistics infrastructure, first-party data, brand recognition.

- Evidence: 95% of shipments handled by MELI logistics, 50% same/next day delivery (Quartr)

E2. Pricing Power (4/5)

Transaction fees of 16-22% maintained. Advertising take rate growing. However, competing with aggressive pricing from Shopee and Temu.

- Evidence: Average take rate 18.5% in 2023, ad penetration 2.0% of GMV (Stock Analysis)

E3. High Barriers to Entry (5/5)

Building comparable logistics network would require billions and years. Regulatory licensing for fintech adds barriers. 25+ years of marketplace trust.

- Evidence: $5.8B Brazil investment alone in 2024 (Mexico Business News)

E4. Low Threat of Disruption (3/5)

Shopee has overtaken MELI by order volume in Brazil. Temu reached 105M MAUs in LatAm. AI could disrupt advertising business.

- Evidence: Shopee at 8.5% market share vs MELI’s 12.1% in Brazil, but MELI leads by GMV (Motley Fool)

E5. Industry Structure – Favorable (4/5)

Consolidating market with MELI as clear leader. E-commerce penetration only 12.3% in LatAm vs 19.7% global average – significant runway.

- Evidence: LatAm e-commerce projected to grow 54% to $232B by 2028 (eMarketer)

E6. Intellectual Property & Brand Value (4/5)

Strong brand recognition across LatAm. Brand Protection Program since 2000. No major patents but proprietary logistics and payment technology.

- Evidence: Brand Protection Program with machine learning (INTA)

E7. Earnings Predictability & Recurring Revenue (5/5)

Fintech provides recurring transaction revenue. Subscription-like seller relationships. Credit portfolio generates interest income. 27 consecutive quarters of 30%+ growth.

- Evidence: Q3 2025 marked 27th consecutive quarter of 30%+ YoY growth (Investor Relations)

Section F: Financial Strength & Capital Efficiency (Score: 28/35)

“The ideal business earns very high returns on capital and can reinvest at those high returns.” — Warren Buffett

F1. Conservative Debt Levels (3/5)

Debt/Equity of 126%, Net Debt/EBITDA of 0.59x. Total debt of $7.2B but strong cash generation. Debt increased to fund credit portfolio growth.

- Evidence: Debt-to-equity increased from 62.7% to 126.4% over 5 years (Simply Wall St)

F2. Strong Credit Rating (4/5)

Investment grade from both S&P (BBB-) and Fitch (BBB-). Upgraded in late 2024.

- Evidence: S&P and Fitch upgrades to BBB- in 2024 (Fitch Ratings)

F3. Adequate Cash Reserves (4/5)

$4.0B in cash and short-term investments. Strong free cash flow of $7.1B in 2024. Interest coverage ratio of 47.8x.

- Evidence: Balance sheet data (Stock Analysis)

F4. No Aggressive Accounting (5/5)

Clean audit opinions. No restatements. Conservative accounting on credit provisions. Transparent about NPL ratios.

- Evidence: SEC filings show no restatements or enforcement actions (SEC EDGAR)

F5. Return on Invested Capital (ROIC) (4/5)

ROIC of ~18-25% (varies by calculation method), significantly above WACC of ~11%. Value creation confirmed.

- Evidence: ROIC 25.56% TTM per GuruFocus (GuruFocus)

F6. Free Cash Flow Generation (5/5)

FCF of $7.1B in 2024 (+52% YoY). FCF 5-year CAGR of 60.6%. Excellent cash conversion.

- Evidence: FCF history (MacroTrends)

F7. Capital Allocation Track Record (3/5)

Excellent reinvestment in logistics and fintech. Limited shareholder returns (no dividend, minimal buybacks). Growing credit portfolio adds risk.

- Evidence: Credit portfolio grew 74% YoY to $6.6B (Investor Relations)

Section G: Country & Geopolitical Risk (Score: 10/15)

“All I want to know is where I’m going to die, so I’ll never go there.” — Charlie Munger

G1. Operates in Rule-of-Law Jurisdictions (3/5)

Brazil (55% of revenue) and Mexico (22%) are developing markets with improving institutions. Argentina (18%) has higher political/economic volatility.

- Evidence: Geographic revenue mix from company filings (Statista)

G2. Limited Geopolitical Exposure (3/5)

No direct China/Russia exposure but faces competition from Chinese platforms (Shopee, Temu). Argentina’s economic instability is a recurring risk.

- Evidence: Argentina peso devaluation of 54% in Dec 2023 impacted results (Bloomberg)

G3. Supply Chain Diversification (4/5)

Primarily a services business with limited physical supply chain. Logistics infrastructure locally developed. Some exposure to device/hardware imports.

- Evidence: 95% of shipments handled through own logistics network

Section H: Valuation & Margin of Safety (Score: 22/35)

“Price is what you pay, value is what you get.” — Warren Buffett

H1. P/E vs Historical Average (4/5)

Current P/E of 50x is 84% below 10-year average of 319x (heavily skewed by early low-profit years). Near 5-year low of 45x.

- Evidence: P/E ratio history (MacroTrends)

H2. P/FCF (Price to Free Cash Flow) (4/5)

EV/FCF of 12.8x is attractive for a high-growth company. P/FCF has declined significantly as FCF expanded.

- Evidence: EV/FCF of 12.80 (Stock Analysis)

H3. EV/EBITDA vs Sector (3/5)

EV/EBITDA of 28.5x is above e-commerce sector median but reflects growth premium. Higher than Amazon (~15x) and PDD (~8x).

- Evidence: EV/EBITDA comparison (Alpha Spread)

H4. PEG Ratio (Growth-Adjusted) (4/5)

PEG ratio of 0.97-1.22 suggests reasonable valuation for growth rate. Forward P/E of ~30-40x with 30%+ growth.

- Evidence: PEG ratio from multiple sources (Yahoo Finance)

H5. P/B Ratio – Graham's Value Test (1/5)

P/B of 16-21x far exceeds Graham’s 1.5x threshold. Not a value stock by Graham standards.

- Evidence: P/B ratio history (MacroTrends)

H6. Graham Number vs Current Price (1/5)

Graham Number analysis not applicable – P/B and P/E product far exceeds 22.5 threshold.

- Evidence: High-growth tech companies rarely meet Graham number criteria

H7. Margin of Safety Assessment (5/5)

Simply Wall St estimates fair value at $2,911 vs current ~$1,967 (32% upside). Analyst consensus price target of $2,872 (+39% upside).

- Evidence: Analyst price targets (Simply Wall St)

Section J: Benjamin Graham Screen

Graham's 7-Point Defensive Investor Criteria

| # | Criterion | Threshold | Current Value | Pass/Fail |

|---|---|---|---|---|

| 1 | Adequate Size | Market Cap > $2B | $100B | ✅ |

| 2 | Strong Financial Condition | Current Ratio ≥ 2.0 | 1.17 | ❌ |

| 3 | Earnings Stability | Positive EPS for 10 consecutive years | ~8/10 years | ❌ |

| 4 | Dividend Record | Uninterrupted dividends 20+ years | 0 years (stopped 2018) | ❌ |

| 5 | Earnings Growth | EPS growth ≥ 33% over 10 years | >1000% | ✅ |

| 6 | Moderate P/E Ratio | P/E ≤ 15 | 50x | ❌ |

| 7 | Moderate P/B Ratio | P/B ≤ 1.5 OR (P/E × P/B) ≤ 22.5 | P/B ~17x | ❌ |

| TOTAL | 7 to pass | 2/7 | FAIL |

Graham Number Analysis

NCAV Analysis

Net Current Asset Value analysis not applicable – MercadoLibre is not a net-net stock. As a high-growth technology company with significant intangible value, NCAV analysis is not appropriate for this type of business.

Graham Screen Summary

Red Flag Analysis

Governance Red Flags (Max: -35 pts)

| Red Flag | Present? | Deduction | Evidence |

|---|---|---|---|

| Unrealistic promises to investors | N | 0 | Consistent achievement of guidance |

| Excessive CEO compensation (>100x median employee) | Y | -3 | CEO $13.7M is high but mostly stock |

| Related-party transactions | N | 0 | None material disclosed |

| Accounting restatements (last 5 years) | N | 0 | Clean audit history |

| High CFO/auditor turnover | N | 0 | CFO transition was planned |

| Reluctance on tough questions | N | 0 | Transparent in earnings calls |

| Corruption/bribery allegations (FCPA) | N | 0 | No allegations |

| Governance Subtotal | -3 |

Financial Red Flags (Max: -21 pts)

| Red Flag | Present? | Deduction | Evidence |

|---|---|---|---|

| High leverage (Debt/EBITDA > 4x) | N | 0 | Net Debt/EBITDA 0.59x |

| ROIC below cost of capital (5yr avg) | N | 0 | ROIC ~18-25% vs WACC ~11% |

| Declining FCF (3 consecutive years) | N | 0 | FCF growing 50%+ annually |

| Net share issuance >2% annually (dilution) | N | 0 | Minimal dilution |

| Gross margin declining >500bps (5yr) | N | 0 | Stable ~47-48% |

| Financial Subtotal | 0 |

Business Risk Red Flags (Max: -14 pts)

| Red Flag | Present? | Deduction | Evidence |

|---|---|---|---|

| Customer/supplier concentration >25% | N | 0 | Highly diversified customer base |

| Single-country exposure >50% revenue | Y | -3 | Brazil at 55% of revenue |

| Revenue decline in 3+ of last 10 years | N | 0 | Consistent growth |

| Unstable government subsidy dependence | N | 0 | No subsidy dependence |

| Business Risk Subtotal | -3 |

Valuation Red Flags (Max: -13 pts)

| Red Flag | Present? | Deduction | Evidence |

|---|---|---|---|

| Stock at >2x 5-year average P/E | N | 0 | Current 50x vs 5yr avg 195x |

| P/FCF > 40 (or negative FCF) | N | 0 | EV/FCF 12.8x |

| Trading >30% above fair value estimate | N | 0 | Trading below analyst targets |

| Valuation Subtotal | 0 |

Red Flag Summary

Critic Review Notes

Source Reliability Summary

- Total Sources Used: 45+

- HIGH Reliability: 38 (84%) – SEC filings, company IR, major financial news

- MEDIUM Reliability (corroborated): 7 (16%) – Analyst reports, Substack research

- Sources Removed (LOW): 0

Hyperlink Validation

- Total hyperlinks: 42

- Links tested: 42

- Links verified working: 42

- Links replaced (broken): 0

- Links removed (no alternative): 0

Score Adjustments

- Section D (Regulatory): Reduced from initial 19 to 17 due to active antitrust scrutiny in Mexico and Argentina

- Section G (Geopolitical): Kept at 10 due to Brazil concentration (55%) and Argentina currency risk

Gaps & Limitations

- Exact insider ownership percentages for all board members not available without premium data access

- NPL trends beyond 2025 not projected

- Competitive dynamics with Shopee/Temu evolving rapidly

All Citations

- MercadoLibre Investor Relations – Company filings and presentations

- SEC EDGAR – MELI Filings – 10-K, 10-Q, DEF 14A

- MacroTrends MELI Financials – Historical financial data

- Yahoo Finance MELI – Real-time quotes and statistics

- Stock Analysis MELI – Metrics and ratios

- GuruFocus MELI – ROIC and valuation metrics

- Simply Wall St MELI – Valuation analysis

- Statista – MercadoLibre Statistics – Market share data

- Fitch Ratings – MELI Upgrade – Credit rating

- Bloomberg – Galperin Profile – CEO transition

- Marcos Galperin Wikipedia – Biography

- Rest of World – MELI Antitrust – Argentina regulatory

- Digital Commerce 360 – Mexico Antitrust – Mexico regulatory

- Motley Fool – MELI Analysis – Competitive analysis

- Quartr – MELI Deep Dive – Business model analysis

- Glassdoor – MercadoLibre Reviews – Employee feedback

- eMarketer – LatAm E-commerce – Market projections

- PYMNTS – MELI Antitrust – Argentina complaint

- Salary.com – Executive Compensation – CEO pay data

- TipRanks – Insider Trading – Insider transactions

Disclaimer: This evaluation is for informational purposes only and does not constitute investment advice. Past performance is not indicative of future results. Investors should conduct their own due diligence before making investment decisions.

Evaluation completed: 2026-01-05

Leave a Reply