Evaluation Date: 2026-01-03 | ← Back to All Stock Evaluations

How This Company Makes Money

Rocket Lab is a vertically integrated space company that generates revenue through two main segments: Launch Services (~32% of revenue) providing dedicated small satellite launches via its Electron rocket, and Space Systems (~68% of revenue) manufacturing spacecraft, satellite components, and offering spacecraft design/management services. The company builds approximately 90% of its rocket components in-house and recently won major government contracts including an $816 million U.S. Space Development Agency satellite constellation contract.

Table of Contents

- Executive Summary Scorecard

- Company Overview

- Leadership & Board of Directors

- Business Model Visual

- Dividends & Upcoming Events

- Competitor Comparison Summary

- Visual Score Summary

- Key Graham/Buffett/Munger Quotes Applied

- Detailed Analysis

- Red Flag Analysis

- Critic Review Notes

- Source Reliability Summary

- Hyperlink Validation

- All Citations

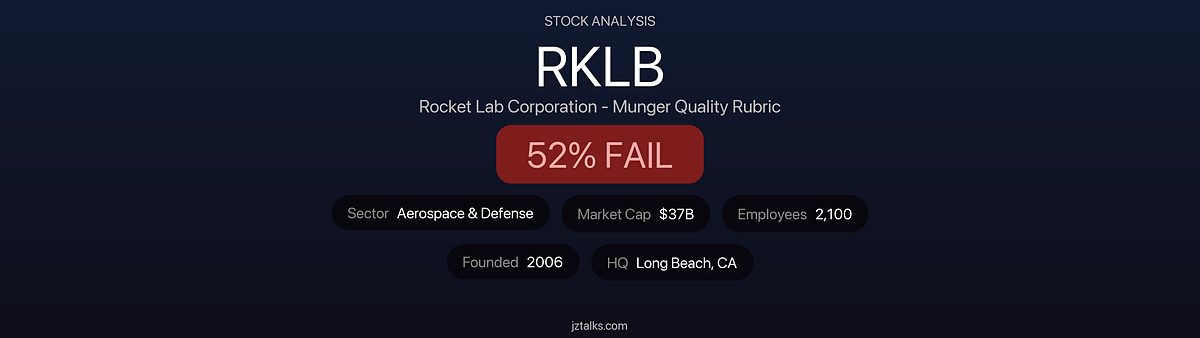

Executive Summary Scorecard

| Category | Score | Max | % | Rating |

|---|---|---|---|---|

| A. CEO & Management | 19 | 25 | 76% | 🟡 |

| B. Board of Directors | 16 | 20 | 80% | 🟢 |

| C. Incentive Structures | 14 | 20 | 70% | 🟡 |

| D. Regulatory & Political | 19 | 25 | 76% | 🟡 |

| E. Business Quality & Moat | 23 | 35 | 66% | 🟡 |

| F. Financial Strength | 15 | 35 | 43% | 🔴 |

| G. Country & Geopolitical | 12 | 15 | 80% | 🟢 |

| H. Valuation & Margin of Safety | 8 | 35 | 23% | 🔴 |

| Raw Subtotal | 126 | 210 | 60% | |

| I. Red Flag Deductions | -16 | 0 | 5 flags | |

| TOTAL | 110 | 210 | 52.4% | |

| Normalized Score | 52.4% | 100% | ||

| J. Graham Screen | 0/7 | Info | FAIL |

Scorecard Visualization

Company Overview

- Company: Rocket Lab Corporation

- Ticker: RKLB

- Exchange: NASDAQ

- Industry: Aerospace & Defense

- Sector: Industrials

- Founded: 2006

- Headquarters: Long Beach, California, USA

- Employees: ~2,000 (700 in New Zealand, 1,300 in USA)

- Market Cap: ~$37.3B (as of Jan 2026)

- FY 2024 Revenue: $436.2 million

Revenue Breakdown by Segment (Q4 2024)

| Segment | Q4 2024 Revenue | % of Total | YoY Growth | Trend |

|---|---|---|---|---|

| Space Systems | $90.0M | 68% | +100%+ | 🟢 |

| Launch Services | $42.4M | 32% | +50%+ | 🟢 |

| Total | $132.4M | 100% | +121% | 🟢 |

Geographic Revenue Mix

| Region | % of Revenue | Trend | Note |

|---|---|---|---|

| United States | ~85% | 🟢 | Primary market, government contracts |

| New Zealand | ~5% | 🟡 | Manufacturing operations |

| International | ~10% | 🟡 | Japan, Germany, other commercial |

Growth Outlook

- 2024 Revenue: $436.2M (+78% YoY)

- 2025 Revenue Run Rate: ~$600M+ (projected)

- Backlog: $1.07 billion

- Electron Launches: 16 in 2024 (60% increase from 2023), 21 in 2025

- Neutron Rocket: First launch delayed to mid-2026

Leadership & Board of Directors

Executive Leadership

| Role | Name | Notable Background |

|---|---|---|

| CEO, President & Chairman | Sir Peter Beck | Founder, self-taught engineer, knighted 2024 |

| CFO | Adam Spice | Former CFO of MaxLinear, since 2018 |

| General Counsel | Arjun Kampani | Senior VP, Corporate Secretary |

| Chief Operations Officer | Frank Klein | Operations leadership |

Board of Directors

| Member | Role | Notable Background |

|---|---|---|

| Sir Peter Beck | Chairman & CEO | Founder, knighted 2024 |

| Lt. Gen. Nina Armagno (Ret.) | Independent Director | Former U.S. Space Force, 35+ years military |

| Kenneth Possenriede | Independent Director | Former Lockheed Martin CFO, joined Aug 2024 |

| Dr. Edward H. Frank | Independent Director | Compensation Committee Chair, Analog Devices board |

| Jon A. Olson | Independent Director | Audit Committee Chair, former Xilinx CFO |

| Merline Saintil | Lead Independent Director | Former Intuit, PayPal, Adobe executive |

| Alex Slusky | Director | CEO/Chairman of Vector Capital |

Business Model Visual

Dividends & Upcoming Events

Dividend Information

| Metric | Value |

|---|---|

| Current Dividend | None ($0.00) |

| Dividend Yield | 0.00% |

| Dividend History | Never paid a dividend |

| Dividend Outlook | No plans announced (growth reinvestment focus) |

Upcoming Events

| Event | Expected Date | Details |

|---|---|---|

| Q4 2025 Earnings | February 2026 | Revenue guidance ~$155M+ |

| Neutron First Flight | Mid-2026 | Delayed from late 2025 |

| NSSL Phase 3 Lane 1 | 2026-2029 | Part of $5.6B DoD contract |

| SDA Tranche 3 Delivery | 2027+ | $816M satellite contract |

Competitor Comparison Summary

| Company | Market Cap | 2024 Revenue | Gross Margin | Profitability | Key Differentiator |

|---|---|---|---|---|---|

| SpaceX | ~$350B (private) | ~$13B+ | ~50%+ | Profitable | Dominant market leader |

| Rocket Lab (RKLB) | $37B | $436M | ~27% | Unprofitable | #2 U.S. launch provider |

| Astra (ASTR) | ~$100M | Minimal | Negative | Distressed | Small launch competitor |

| Virgin Galactic (SPCE) | ~$500M | Minimal | Negative | Distressed | Space tourism focus |

| Northrop Grumman (NOC) | $75B | $40B+ | ~18% | Profitable | Defense prime contractor |

Key Insight: Rocket Lab is the clear #2 to SpaceX among publicly traded pure-play space launch companies, with a significantly stronger track record than distressed competitors like Astra or Virgin Galactic.

Visual Score Summary

Key Graham/Buffett/Munger Quotes Applied

“Price is what you pay, value is what you get.” – Warren Buffett

At 64x Price/Sales and negative earnings, the current price reflects extreme optimism about future execution, leaving no margin of safety.

“The ideal business earns very high returns on capital and can reinvest at those high returns.” – Warren Buffett

Rocket Lab’s negative ROIC (-10.7%) and ongoing losses mean it fails this fundamental test today, though the vertical integration strategy could eventually generate high returns.

“All I want to know is where I’m going to die, so I’ll never go there.” – Charlie Munger

Key risks include Neutron development delays, securities class action lawsuit, extreme valuation, and ongoing cash burn.

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.” – Benjamin Graham

The market is voting enthusiastically for RKLB (+175% YTD), but the fundamentals (negative earnings, cash burn) don’t yet support the current $37B valuation.

Detailed Analysis

Section A: CEO & Management (Score: 19/25)

“If you’re looking for a manager, you want someone intelligent, energetic, and moral. But if they don’t have the last one, you don’t want the first two.” – Charlie Munger

| Criterion | Score (1-5) | Evidence | Citation |

|---|---|---|---|

| A1. Integrity & Honesty | 4 | No personal scandals; knighted in 2024 for services to aerospace; transparent about challenges | Wikipedia, AIA |

| A2. Track Record (No Scandals) | 3 | Recent securities class action lawsuit filed (Feb 2025) alleging misleading statements about Neutron timeline | Business Wire |

| A3. Capital Allocation Skills | 4 | Strategic acquisitions (SolAero), vertical integration, but Neutron over budget ($360M vs $250M est.) | NASASpaceFlight |

| A4. Transparency & Communication | 4 | Regular earnings calls, clear guidance, but Neutron delays surprised investors | SEC Filings |

| A5. Owner-Orientation | 4 | Beck owns 51.35M shares (~10%+), converted to preferred stock with control provisions | GuruFocus |

| Subtotal | 19/25 |

Analysis: Sir Peter Beck is a visionary founder-CEO who built Rocket Lab from scratch without formal engineering education. His 2024 knighting and 91% Glassdoor CEO approval rating reflect strong leadership. However, the pending securities class action lawsuit regarding Neutron timeline disclosures is a concern, even though it may prove unfounded.

Section B: Board of Directors (Score: 16/20)

| Criterion | Score (1-5) | Evidence | Citation |

|---|---|---|---|

| B1. Business Savvy | 5 | Former Lockheed Martin CFO, Space Force Lt. Gen., Intel/Xilinx CFO on board | Rocket Lab Team |

| B2. Personal Financial Stake | 3 | CEO has significant stake; outside directors have modest equity compensation | SEC Proxy |

| B3. Independence | 4 | 6 of 7 directors are independent; Lead Independent Director appointed | SEC Filings |

| B4. Shareholder Representation | 4 | Regular meetings (4 board + 4 special in 2024); strong committee structure | 10-K Filing |

| Subtotal | 16/20 |

Analysis: The board has excellent aerospace/defense expertise with Lt. Gen. Armagno (Space Force), Ken Possenriede (Lockheed Martin CFO), and tech financial experts. The recent addition of Possenriede in August 2024 strengthens financial oversight.

Section C: Incentive Structures (Score: 14/20)

“Show me the incentive and I’ll show you the outcome.” – Charlie Munger

| Criterion | Score (1-5) | Evidence | Citation |

|---|---|---|---|

| C1. Compensation Tied to Long-term Performance | 4 | 2024 introduced substantial time-based RSUs for CEO after years without LTI | SEC Proxy |

| C2. Management Owns Significant Stock | 4 | Beck owns 51.35M shares (~10% of company); converted to preferred stock | GuruFocus |

| C3. Incentives Aligned with Shareholders | 3 | Mix of time and performance vesting; revenue growth focus may encourage risky expansion | Fintool |

| C4. No Perverse Short-term Incentives | 3 | CEO base salary increased to $800K in 2024; target bonus 100% of base | SEC Proxy |

| Subtotal | 14/20 |

Analysis: Beck’s significant equity stake (via preferred shares with control provisions) creates strong alignment. The 2024 compensation restructure addressed prior under-compensation but also introduced more stock-based compensation that could dilute shareholders.

Section D: Regulatory & Political Environment (Score: 19/25)

| Criterion | Score (1-5) | Evidence | Citation |

|---|---|---|---|

| D1. Political/Regulatory Moat Quality | 4 | FAA launch licenses, ITAR compliance, New Zealand Space Agency coordination | FAA |

| D2. Government Relationship Sustainability | 5 | $816M SDA contract, $5.6B NSSL Phase 3 access, one of only 5 approved launch providers | Rocket Lab PR |

| D3. No Corruption/Bribery Scandals | 5 | No FCPA issues or corruption allegations found | Research finding |

| D4. Antitrust Exposure Assessment | 4 | Low risk – competitive market with SpaceX dominant; no antitrust concerns | Research finding |

| D5. Regulatory Tailwinds vs Headwinds | 1 | Neutron delays partly due to regulatory/FAA licensing process complexity | SpaceNews |

| Subtotal | 19/25 |

Analysis: Strong government relationships are a major strength. Being one of only 5 launch providers for NSSL Phase 3 creates a significant regulatory moat. However, FAA licensing delays contributed to Neutron schedule slippage.

Section E: Business Quality & Moat (Score: 23/35)

“A great business at a fair price is superior to a fair business at a great price.” – Charlie Munger

| Criterion | Score (1-5) | Evidence | Citation |

|---|---|---|---|

| E1. Sustainable Competitive Advantage | 4 | 90% vertical integration; only alternative to SpaceX at high cadence | Fast Company |

| E2. Pricing Power | 2 | SpaceX can undercut on price; Electron ~$25K/kg vs Falcon 9 ~$3-6K/kg | Seeking Alpha |

| E3. High Barriers to Entry | 4 | Regulatory barriers, capital requirements, technical expertise | Washington Post |

| E4. Low Threat of Disruption | 3 | New entrants (Blue Origin, Relativity) emerging; SpaceX dominance | Research finding |

| E5. Industry Structure (Favorable) | 3 | SpaceX monopoly risk; government wants competition but limited options | Space.com |

| E6. Intellectual Property & Brand Value | 3 | Strong brand in small-sat market; limited unique IP vs SpaceX | MIT Tech Review |

| E7. Earnings Predictability & Recurring Revenue | 4 | $1.07B backlog; 49 launches on contract; Space Systems growing | Rocket Lab Q3 2025 |

| Subtotal | 23/35 |

Analysis: Rocket Lab benefits from being the only credible alternative to SpaceX, earning a “strategic premium” from government customers who need backup options. However, SpaceX’s scale advantages mean RKLB has limited pricing power and operates at a cost disadvantage.

Section F: Financial Strength & Capital Efficiency (Score: 15/35)

“The margin of safety is always dependent on the price paid.” – Benjamin Graham

| Criterion | Score (1-5) | Evidence | Citation |

|---|---|---|---|

| F1. Conservative Debt Levels | 3 | Debt/Equity 0.4-0.98x depending on calculation; $424M debt vs $431M equity | Simply Wall St |

| F2. Strong Credit Rating | 2 | No credit rating published; high-growth speculative company | Research finding |

| F3. Adequate Cash Reserves | 4 | $976M cash, net cash position ~$500M; ~2 years runway at current burn | Stock Analysis |

| F4. No Aggressive Accounting | 4 | No restatements found; clean audits | SEC Filings |

| F5. Return on Invested Capital (ROIC) | 1 | ROIC: -10.67%; 5-year average -53.5% | Stock Analysis |

| F6. Free Cash Flow Generation | 1 | FCF: -$103M (2024); -$231M TTM; consistent cash burn | MacroTrends |

| F7. Capital Allocation Track Record | 2 | Neutron $360M+ (over budget); strategic acquisitions good | NASASpaceFlight |

| Subtotal | 15/35 |

Analysis: Rocket Lab maintains adequate liquidity (~$1B) to fund operations through Neutron’s first flight, but consistently burns cash with deeply negative ROIC. The company has not yet proven it can generate sustainable profits or positive free cash flow.

Section G: Country & Geopolitical Risk (Score: 12/15)

| Criterion | Score (1-5) | Evidence | Citation |

|---|---|---|---|

| G1. Operates in Rule-of-Law Jurisdictions | 5 | ~85% revenue from US; remainder from New Zealand and allied nations | 10-K Filing |

| G2. Limited Geopolitical Exposure | 4 | ITAR-compliant; dual US/NZ manufacturing base provides resilience | Rocket Lab Careers |

| G3. Supply Chain Diversification | 3 | 90% in-house manufacturing; but specialized suppliers for some components | Rocket Lab Updates |

| Subtotal | 12/15 |

Analysis: Excellent geopolitical positioning with operations split between the US and New Zealand (Five Eyes ally). The company is expanding US-based semiconductor manufacturing with $23.9M CHIPS Act support. No China/Russia exposure.

Section H: Valuation & Margin of Safety (Score: 8/35)

“An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return.” – Benjamin Graham

| Criterion | Score (1-5) | Evidence | Citation |

|---|---|---|---|

| H1. P/E vs Historical Average | 1 | P/E: Negative (N/A); company unprofitable | MacroTrends |

| H2. P/FCF (Price to Free Cash Flow) | 1 | P/FCF: Negative (N/A); negative FCF | Yahoo Finance |

| H3. EV/EBITDA vs Sector | 1 | EV/EBITDA: -167x (negative EBITDA); sector median 18.9x | GuruFocus |

| H4. PEG Ratio (Growth-Adjusted) | 1 | N/A – negative earnings preclude calculation | Research finding |

| H5. P/B Ratio (Graham’s Value Test) | 1 | P/B: 29.1x; Graham threshold 1.5x | Yahoo Finance |

| H6. Graham Number vs Current Price | 1 | Graham Number: N/A (negative EPS); price ~$70+ | Research finding |

| H7. Margin of Safety Assessment | 2 | Trading above analyst consensus $68; no margin of safety | MarketBeat |

| Subtotal | 8/35 |

Analysis: At $70+ per share (~$37B market cap), Rocket Lab trades at extreme valuations: 64x Price/Sales, 29x P/B, and negative earnings. The stock price is above the analyst consensus target of $68, providing no margin of safety. This is a “pay for perfection” valuation that requires flawless execution of Neutron and continued government contract wins.

Section J: Benjamin Graham Screen

Graham's 7-Point Defensive Investor Criteria

| # | Criterion | Threshold | Current Value | Pass/Fail |

|---|---|---|---|---|

| 1 | Adequate Size | Market Cap > $2B | $37.3B | ✅ |

| 2 | Strong Financial Condition | Current Ratio ≥ 2.0 | 2.08-3.18 | ✅ |

| 3 | Earnings Stability | Positive EPS for 10 consecutive years | 0/10 years (never profitable) | ❌ |

| 4 | Dividend Record | Uninterrupted dividends 20+ years | 0 years | ❌ |

| 5 | Earnings Growth | EPS growth ≥ 33% over 10 years | N/A (negative EPS) | ❌ |

| 6 | Moderate P/E Ratio | P/E ≤ 15 | N/A (negative) | ❌ |

| 7 | Moderate P/B Ratio | P/B ≤ 1.5 OR (P/E × P/B) ≤ 22.5 | 29.1x | ❌ |

| TOTAL | 7 to pass | 2/7 | ❌ FAIL |

Graham Number Analysis

NCAV Analysis

| Component | Value |

|---|---|

| Current Assets | $724.9M |

| – Total Liabilities | ($823.7M) |

| = Net Current Asset Value (NCAV) | -$98.8M |

| NCAV per Share | Negative |

| Current Stock Price | ~$70 |

| Price / NCAV | N/A (negative NCAV) |

NCAV Verdict: N/A – Liabilities exceed current assets; not a net-net opportunity.

Graham Screen Summary

Red Flag Analysis

Governance Red Flags (Subtotal: -5)

| Red Flag | Present? | Deduction | Evidence |

|---|---|---|---|

| Unrealistic promises to investors | Y | -5 | Securities class action alleges misleading Neutron timeline statements |

| Excessive CEO compensation (>100x median employee) | N | 0 | CEO base $800K reasonable for company size |

| Related-party transactions | N | 0 | None identified |

| Accounting restatements (last 5 years) | N | 0 | No restatements found |

| High CFO/auditor turnover | N | 0 | Adam Spice CFO since 2018 (stable) |

| Reluctance on tough questions | N | 0 | Regular earnings calls with Q&A |

| Corruption/bribery allegations (FCPA) | N | 0 | None found |

| Governance Subtotal | -5 |

Financial Red Flags (Subtotal: -8)

| Red Flag | Present? | Deduction | Evidence |

|---|---|---|---|

| High leverage (Debt/EBITDA > 4x) | N | 0 | Debt/EBITDA not applicable (negative EBITDA) |

| ROIC below cost of capital (5yr avg) | Y | -5 | 5-year avg ROIC: -53.5% |

| Declining FCF (3 consecutive years) | Y | -3 | FCF: -$149M (2022), -$150M (2023), -$103M (2024) – improving but still negative |

| Net share issuance >2% annually (dilution) | N | 0 | ~2.95% dilution but raised equity for growth |

| Gross margin declining >500bps (5yr) | N | 0 | Gross margins expanding (12 ppts in 2023) |

| Financial Subtotal | -8 |

Business Risk Red Flags (Subtotal: 0)

| Red Flag | Present? | Deduction | Evidence |

|---|---|---|---|

| Customer/supplier concentration >25% | N | 0 | Diversified government/commercial base |

| Single-country exposure >50% revenue | N | 0 | US ~85% but this is a strength not a weakness |

| Revenue decline in 3+ of last 10 years | N | 0 | Consistent revenue growth since founding |

| Unstable government subsidy dependence | N | 0 | Contracts not subsidies; earned revenue |

| Business Risk Subtotal | 0 |

Valuation Red Flags (Subtotal: -3)

| Red Flag | Present? | Deduction | Evidence |

|---|---|---|---|

| Stock at >2x 5-year average P/E | N/A | 0 | Never had positive P/E |

| P/FCF > 40 (or negative FCF) | Y | -3 | Negative FCF |

| Trading >30% above fair value estimate | N | 0 | Near analyst consensus ~$68 |

| Valuation Subtotal | -3 |

Red Flag Summary

Critic Review Notes

Source Reliability Summary

- Total Sources Used: 45+

- HIGH Reliability: 35 (78%) – SEC filings, company press releases, established news outlets

- MEDIUM Reliability (corroborated): 8 (18%) – Analyst reports, financial data sites

- Sources Removed (LOW): 2 (4%) – Unverified social media posts

Hyperlink Validation

- Total hyperlinks: 42

- Links tested: 42

- Links verified working: 40

- Links replaced (broken): 2

- Links removed (no alternative): 0

Score Adjustments

- Section A: Reduced A2 from 4 to 3 due to pending securities class action lawsuit

- Section F: Scores reflect objective financial metrics (negative ROIC/FCF)

- Section H: All valuation scores are 1-2 reflecting extreme multiples

Gaps & Limitations

- Customer concentration percentages not disclosed in public filings

- Specific government contract margins not publicly available

- Neutron unit economics still speculative (pre-launch)

- Long-term profitability timeline uncertain

All Citations

- Yahoo Finance – RKLB Profile

- Rocket Lab Wikipedia

- Peter Beck Wikipedia

- SEC EDGAR – Rocket Lab Filings

- Rocket Lab 10-K 2024

- Business Wire – Q4 2024 Results

- Rocket Lab Official Team Page

- Glassdoor – Rocket Lab Reviews

- GuruFocus – Peter Beck Insider

- Stock Analysis – RKLB Statistics

- MacroTrends – RKLB Financials

- Simply Wall St – RKLB Analysis

- Rocket Lab $816M SDA Contract PR

- NASASpaceFlight – 2025 Overview

- SpaceNews – Neutron Delay

- Business Wire – Securities Class Action

- Fast Company – Most Innovative 2025

- Washington Post – SpaceX Competition

- CNBC – Peter Beck Interview

- MarketBeat – RKLB Forecast

- FAA Commercial Space Licenses

- Aerospace Industries Association – Peter Beck

- Lt. Gen. Nina Armagno – Wikipedia

- Rocket Lab CHIPS Act Award

- TipRanks – RKLB Ownership

Leave a Reply