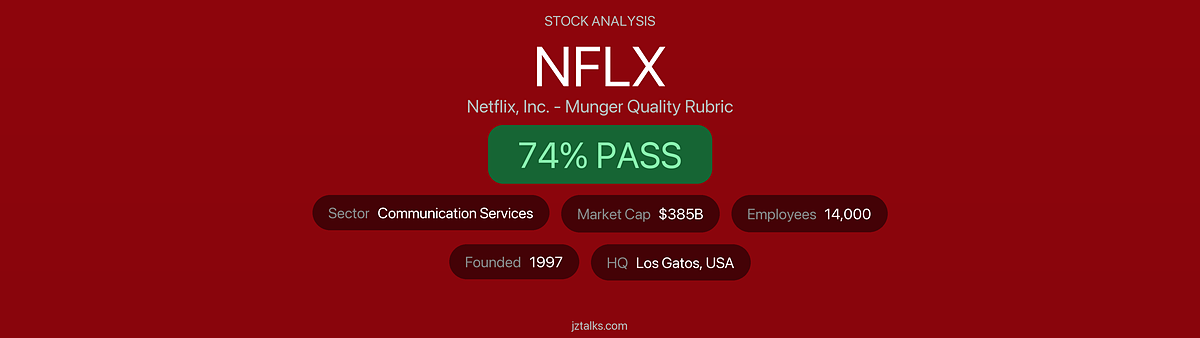

View All Stock Evaluations | Evaluation Date: 2026-01-12

Key Takeaways: Is NFLX a Quality Investment?

This section provides a scannable summary for quick reference.

- Verdict: PASS — Score: 156/210 (74.3%)

- Moat Strength: Strong — Global streaming leader with 300M+ subscribers, unmatched content library, and network effects from data-driven personalization

- Financial Health: Excellent — ROIC 24%+, FCF $9B, Debt/EBITDA ~1.0x, A/A3 credit rating

- Valuation: Fair to Slightly Overvalued — P/E 37x vs 5yr avg 47x, but pending $72B Warner Bros. acquisition adds uncertainty

- Key Risk: The proposed Warner Bros. Discovery acquisition could face antitrust challenges and significantly increase leverage